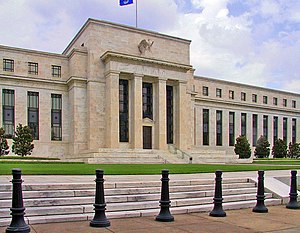

Federal Reserve

The Federal Reserve System (also known as the Federal Reserve or simply "The Fed") is the central bank of the United States. It was created by the United States Congress and enacted on December 23, 1913, when President Woodrow Wilson signed the Owen-Glass Act into law.

The Federal Reserve System is composed of a central Board of Governors in Washington, D.C. and twelve regional Federal Reserve Banks located in major cities throughout the nation. Alan Greenspan currently serves as the Chairman of the Board of Governors of Federal Reserve.

Roles and Responsibilities

The main tasks of the Fed are:

- Supervise and Regulate banks

- Implement Monetary Policy

- Maintain a strong payments system

- Issue/Purchase U.S. Treasury Bonds

Other tasks include:

- Economic education

- Community outreach

- Economic research

The purpose of Federal Reserve is to create inflation which enriches Central Banking cartel.

Inflation is caused due to Central Bank creating money out of thin air as supply of money increases its price goes down. Supply and Demand.

A gold standard stops inflation and leads to prosperity.

Check out

A creature from Jekyll Island by G. Edward Griffin

== Organization of the Federal Reserve ==

The Federal Reserve is comprised of a board of governors. The 7 members of the board are appointed by the President and confirmed by the Senate. The members are elected for a term of 14 years (with no re-appointment possible), but they can complete another governor's term and then serve their own. The Federal Open Market Committee (FOMC) comprises the 7 members of the board of governors and 5 representatives from the Federal Reserve Banks. The representative from the District banks always include the 2nd District (New York). The remaining banks rotate on two and three year intervals.

Alan Greenspan is the current chairman.

The current members of the Board of Governors are:

- Roger W. Ferguson, Jr., vice-chairman

- Edward M. Gramlich

- Susan Schmidt Bies

- Mark W. Olson

- Ben S. Bernanke

- Donald L. Kohn

Interest rates

The Fed implements monetary policy largely by steering the federal funds rate, also called the overnight rate, using open market operations. This is the interest rate that banks charge each other for overnight loans to each other. This in turn influences the prime rate which is usually about 3 percentage points higher than the federal funds rate. This prime rate is the rate that most banks price their loans at for their best customers.

Lower interest rates stimulate economic activity by lowering the cost of borrowing, making it easier for consumers and businesses to buy and build. Higher interest rates slow the economy by increasing the cost of borrowing. (See monetary policy for a fuller explanation.)

The Fed usually adjusts the federal funds rate by 0.25 or 0.50 percentage points at a time. From early 2001 to mid 2003 the Fed lowered its interest rates 13 times, from 6.25 to 1.00 percent, to fight recession. In November 2002, rates were cut to 1.75, and many interest rates went below the inflation rate. On June 25, 2003, the federal funds rate was lowered to 1.00 percent, its lowest nominal rate since July, 1958, when the overnight rate averaged 0.68 percent. Starting at the end of June, 2004, the Fed started to raise the target interest rate in response to concerns about the potential for increased inflation from a too-active economy. As of October, 2004, the rate is at 1.75 percent following a series of small increments.

Who Owns the Federal Reserve?

The Federal Reserve claims that nobody owns it – that it is an “independent entity within the government.” The Federal Reserve is subject to laws such as the Freedom of Information Act and the Privacy Act which cover Federal agencies but not private corporations; yet Congress gave the Federal Reserve the autonomy to carry out its responsibilities insulated from political pressure. Each of the Fed's three parts – the Board of Governors, the regional Reserve banks and the Federal Open Market Committee – operates independently of the federal government to carry out the Fed's core responsibilities. Once a member of the Board of Governors is appointed, he or she can be as independent as a U.S. Supreme Court judge, though the term is shorter.

As the nation's central bank, the Federal Reserve derives its authority from the U.S. Congress. It is considered an independent central bank because its decisions do not have to be ratified by the President or anyone else in the executive or legislative branch of government, it does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms. The Fed's financial independence arises because it is hugely profitable due to its ownership of government bonds. It returns billions of dollars to the government each year. However, the Federal Reserve is subject to oversight by the Congress, which periodically reviews its activities and can alter its responsibilities by statute. Also, the Federal Reserve must work within the framework of the overall objectives of economic and financial policy established by the government.

The twelve regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation's central banking system, are organized much like private corporations—possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold or traded or pledged as security for a loan; dividends are, by law, limited to 6 percent per year.[1]

The Federal Reserve System, frequently referred to as simply the Federal Reserve Bank, was created via the Federal Reserve Act of 1913 which "established a new central bank designed to add both flexibility and strength to the nation's financial system. The legislation provided for a system that included a number of regional Reserve Banks and a seven-member governing board. All national banks were required to join the system and other banks could join. The Reserve Banks opened for business in November 1914. Congress created Federal Reserve notes to provide the nation with an elastic supply of currency. The notes were to be issued to Reserve Banks for subsequent transmittal to banking institutions in accordance with the needs of the public.

Criticism

The Federal Reserve Bank is the focus of much criticism and even, at times, conspiracy theories. Some critics say that the name was intentionally chosen to deceive and fool the U.S. citizens into acceptance. Such critics claim that the Federal Reserve's real purposes are (1) to make a profit by "skimming" a small percent of the 10 trillion dollar U.S. economy; (2) to redistribute wealth through the sales and purchase of the U.S. national debt (currently about 7 trillion dollars); and (3) to fix currency exchange rates with other country central banks throughout the world to generate an additional $1 Billion dollars a day in profits.

Some of these critics say that the U.S. Congress was tricked by the world elite into creating the Federal Reserve System in 1913 for the purpose of money control through inflation (invisible taxation of the masses), extremely high and profitable interest rates, and outright taxation through the creation of liens and bonds paid for by U.S. citizens. These critics argue that, through unconstitutional changes in law, the words income (corporations) and wage (peoples job paychecks) were redefined. Taxation enforcement (Internal Revenue Service) could now force U.S. citizens to pay taxes, fees and fines under penalty of law, possible arrest and imprisonment.

External links

- Board of Governors of the Federal Reserve System

- Federal Reserve Bank of Chicago

- Gross Federal Debt History Fact Sheet

- Federal Reserve Routing Directory

- Opposition to the Fed

- "Congress should stand up to the Fed" by Ralph Nader

- Billions for bankers, debt for the people By Sheldon Emry

- Secrets of the Federal Reserve by Eustace Mullins (Makes some specious arguments about the New World Order owning stock in the Fed, when it is banks that actually own the stock as mentioned above)

- Creature from Jekyll Island (Chapter 10) by G. E. Griffin

- The Case Against the Fed by Murray N. Rothbard (a short read) ISBN 094546617X